As global demand for copper intensifies, driven by the energy transition, digitalization, and the expansion of green technologies. The projected shortfall in copper supply to meet growing global demand underscores the need for sustainable alternatives with lower environmental impact.

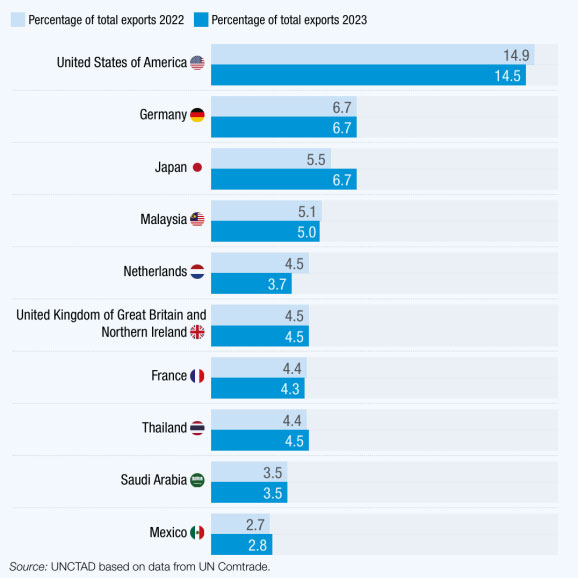

One promising solution is copper recycling, which preserves the metal’s physical and chemical properties without degradation. Recycling also requires significantly less energy than mining and refining newly extracted copper, leading to lower greenhouse gas emissions. As industries increasingly prioritize sustainability and circular economy principles, recycled copper is playing a vital role in meeting demand. Countries can also derive economic benefits by exporting copper scrap to nations with advanced recycling infrastructure. According to the International Copper Study Group, nearly one-third of global copper use in 2023 came from recycled sources. Developed countries are the primary exporters of copper waste and scrap for recycling. In 2023, the United States alone accounted for 14.5 per cent of these exports, followed by Germany (6.7 per cent), Japan (6.7 per cent), Malaysia (5 per cent), and the Netherlands (3.7 per cent).

Trend: SX-EW

Two major trends are driving a surge in metal demand: growth of the metal-intensive global middle class and the shift to electrification and electric mobility, which require vast amounts of copper and battery metals. These green technologies are far more metal-dependent than the carbon-based systems they replace.

To meet this demand, hydrometallurgy is gaining more and more attention. It offers key advantages over traditional methods like smelting and flotation. First, it requires less energy-intensive grinding of ore. Second, it operates at lower temperatures using electricity, avoiding the high energy use and carbon emissions of smelting.

A third major advantage is superior circularity. Materials like acidified water can often be immediately reused within the process. Contrary to expectations, hydrometallurgy frequently uses significantly less water per unit of metal produced compared to other methods like flotation.

Strategic Responses

The global copper industry faces a looming supply deficit, driven by rising demand from electrification, artificial intelligence, and clean energy technologies. This is compounded by declining ore grades, geopolitical risks, and long project development timelines—typically ranging from 15 to 25 years. To address these challenges, exploration and project development must be accelerated through streamlined permitting, financial incentives, and investment in advanced extraction technologies. Enhanced collaboration between major producers and junior mining firms can also help expedite project timelines and stabilize supply.

Diversification of supply sources will be crucial. Strategic trade partnerships between producing and consuming countries can help mitigate tariff-related barriers, while fostering regional value chains will bolster industry resilience. Encouraging domestic utilization of copper—particularly through local refining, smelting, and manufacturing—will reduce reliance on exports and promote industrial self-sufficiency.

To compete effectively in a rapidly evolving global market, copper-exporting countries must transition from raw material providers to value-added producers. Key policy measures include tax incentives for downstream processing, development of industrial parks, support for high-value copper product manufacturing, and negotiation of improved market access. Mechanisms such as the European Union’s Everything But Arms (EBA) or the Generalized System of Preferences (GSP) offer important pathways for expanding trade under preferential terms

Moreover, mining alone will not meet future copper demand. Circular economy strategies, such as scaling up recycling and secondary copper production, will be essential in closing the gap between supply and demand.

In conclusion, the global copper industry is entering a pivotal phase—one that calls not only for increased production, but also for smarter, more inclusive, and technologically driven growth strategies. Reducing trade barriers, building industrial capabilities, and embracing innovation will be central to ensuring that copper-rich developing countries benefit more equitably from the green and digital transitions.